This is Part 2 of a 2 part conversation with world leading macro-economist Paul Zane Pilzer as he continues to predict the future of our Global Economies in light of the current Universal Pandemic Crisis caused by the COVID-19 Virus on this TWO-PART Series. AND if you haven’t listened to Part 1 yet, click here, and make sure you listen to that episode first!

This Episode was recorded on Saturday, March 21, 2020.

SHOW NOTES

- The timing of the bottoming out and recovery of our economy is dependent on a biological medical solution for COVID-19.

- The economical effects of COVID-19 vary by industry and company. Those that are able to quickly adapt to changes and incorporate technology will survive and thrive.

- Businesses that can be moved online like live events will adjust and grow based on demand. Other industries like airlines and restaurants will recover differently as people will be hesitant to return to work or travel in confined spaces with out knowing how COVID-19 will be contained. Depending on the biological medical solutions available and how quickly they are available will greatly impact specific industries.

- There will be an increased demand for medical supplies.

- Our lifestyles, spending, and careers will change as a result of COVID-19.

- The banks will play a major role in the recovery of our economy. Loans are typically only given when there’s collateral. Without collateral our banking system risks collapse.

- If unsecured loans are given the government will have to back them. Government bonds will be securing loans provided by the government.

- Foreign investors feel U.S. Bonds are a more secure investment than their own countries, so we will see an influx of foreign funds that will support the recovery of our economy.

- The U.S. and Canada are likely to recover more quickly economically than other countries.

- Real estate investors and landlords will be adversely affected as their tenants may be unable to pay rents affecting their ability to pay their mortgages. The government is going to have to step in and help like they did for GM.

- Big Box Retail will likely be hit hardest as more businesses will turn to technology.

- We’re going to see the government stepping in and more socialism. Due to globalization, even more people are going to be out of work due to technology.

- The needs of many outweigh those of a few.

TRANSCRIPT:

A Conversation with Leading Macro-Economist

Paul Zane Pilzer and Niurka

Welcome to the Supreme Influence Show, the space to embody your infinite potential and fulfill your highest destiny.

Hi, I’m Niurka, and I’m inspired to bring you this amazing episode.

This is Part 2 of Economic Predictions in Light of COVID-19: the Recovery and Rebuild with our very special guest, world-renowned Macroeconomist, Paul Zane Pilzer. If you missed Part 1, please be sure to go listen to Part 1 first; right now, because it sets the foundation of today’s show.

Paul is a macroeconomist, who has advised CEOs worldwide. He’s served as economic advisor in 2 presidential administrations. He’s an entrepreneur who has founded 5 companies, a professional speaker, adjunct professor at NYU, a writer, New York Times best-selling author with 11 books and a dear friend for over 20 years. Paul has his finger on the pulse of global and national economics and today I am honored to share his brilliance and timely message with you.

This show gives you greater awareness and knowledge of the recovery and rebuild after COVID-19 and you’ll receive economic predictions over the next 10 years with glimpses of his soon to be released book The Roaring Twenties. As challenging as the COVID-19 pandemic is and has been for us all, Paul reveals positive news and projections in the midst of the chaos and how we can be wisely prepared in these changing times. He’s a revolutionary thought leader who has debunked traditional economic theories on scarcity, offering a new theory called economic alchemy based on abundance and revealing how our world contains unlimited resources because our creativity, ingenuity and exponential technologies empower us to continually evolve and define new resources and discover even better ways to use our existing resources.

I’m inspired to bring Paul’s profound wisdom to you today on this episode. It was recorded during a Saturday morning video chat, where I invited a small group of friends to join me in this conversation. Keep in mind that things are changing fast, and even though that’s the case, this information offers you essential insight and understanding of macroeconomics and how it relates to you, your family, your business, your finances, our communities, our global structures and our world. So let’s dive into Part 2.

Everything will be driven by Biology

Paul: And it’s that, so what it’s really going to lead to is some companies are going to go up and some going down, and it’s the microeconomist, not me – I’m a macroeconomist; the microeconomists who can study each individual business. Right now, for example, what’s going on with unemployment? Companies, the CEOs, are stepping up. First thing I saw a week, last week was every CEO I could see in the news, started out with “I am having my salary effective today.” You heard that everywhere and now they’re going through, “I’m at zero salary.” Why? Because the employees are at zero. The company that lays off the fastest and goes to zero employees has the highest EBIDA cause they still have sales in their supply chain from things that are already made. And that company stock goes up the highest.

The company that doesn’t do that, and tries to act compassionate doesn’t have a stock as a currency to go raise more money and build out. It’s kind of terrible right now. And, the hourly workers are all going to be massively cut in my mind in 2 days, 8 days. I mean the bad things that are happening are happening. That said, all this will be driven by biology.

We could still open Pilot Fitness on March 31 like we told everyone we plan to a week ago, if we get the COVID virus under control, either by stopping contagion, communicating it, or cure- finding a cure for those who have it or a combination of both.

Niurka: Okay, so in response to when is the market gonna bottom out, we don’t know. It’s going to be based on the solution to this virus.

Paul: Biologically. Biological medical solution.

The Economical Effect Will Vary by Industry and Even by Company

Paul: Then we now have to go through industry by industry, company by company. The event business for meetings like this is going to soar. I mean if you look at the rate of the companies like Zoom, this is the platform you’re using right now. By being one of the best platforms; I think they’re great. Their stock’s going crazy.

Niurka: Their stock’s going crazy. I just saw their stock. Yeah.

Paul: And so the event business and people who supply it, it’ll be like more, I see this and I look at all your heads here. I see this more like a giant Vegas slot machine. I put in my tokens to get boom, boom, boom. I want six economists. I want 10. I want 30 Niurkas and the whole staff to help me out and coach my team. And you buy it on demand, and you don’t have all the logistics you had in the event business, meaning getting everyone to one place. They just pop online and then somebody comes up in your company with the question or your client comes up and all these experts are assembled there.

That’s effectively going on. I’m not being paid for it. I’m on multiple chat groups that meet like this of bank regulators. I don’t know why I’m on this one. I’ve had to research it. Major medical schools, they want to know how the supply chain will continue to keep getting the medical supplies, which by the way is our current major crisis in medicine right now, is getting the supply chain of tools to the doctors. Keep them safe.

We’re going to see the event business go a very significant part online. Note, it’s fundamental change and that might even lead to more revenues. We certainly see businesses completely change. Remember the days you had to have a travel agent to book a flight? We’ve seen whole industries change quickly. They’re going to change really quickly now and it’s really almost, I don’t have an answer for which one it is.

Certain industries are going to take a while to come back. And again it comes, it comes down to medically. Are we gonna slow down COVID? So it’s, so it’s manageable like the flu, or are we gonna eliminate it entirely? I mean airplanes are really scary places to sit there for 6 hours and circulate the same air, really refreshing it and they do their best to not get COVID. I had a friend, I was on a group with all Delta pilots, and every one of them thinks they have COVID. They said, “Paul, there’s no way I can fly plane back and forth. 24 hours.”

Niurka: What do you see happening with those industries? What do you see happening with the airlines and with the hotels?

Paul: And I’m sorry to duck it, but it’s medical. If we come up with something that no pilot can get COVID, Bing! Going right back to work. People are dying to travel. Not everyone has money, but somebody does. They had their vacations all set, especially if it’s April or May and everything’s being pushed out a little bit.

Another good example, I attend an economic conference each year, on where the world’s going, of a thousand leading people put on by Wharton Business School. It’s my favorite con[ference] group and last year it was in Shanghai. This year I was on my way there March 3rd, March 2nd and they canceled it. The government in Singapore said, “I’m not going to let a thousand prominent heads of state and economists fly into Singapore,” and all get, just when we conquered COVID – they thought they had March 3rd – so they canceled the event. Now they just rescheduled it. It’s crazy. Last week, I got a notice it’s on for June 11th. I thought they’d skip this year. And we do the 2021 one, it’s on for June 11. It’s technically, as of today, if you Google Wharton Economic Conference Singapore, it’s on for Singapore on June 11th. Now, the last 4 days make it look like it’s going to close. But you see what’s happened.

If someone asked me to build a model, I’m very good if you give me the date that we’ve conquered COVID. sounded like, when is World War 2 going to end? And I’ll know when I tool up everything, but that everything depends on that medical date.

Our Lifestyles Will Be Different As We Rebuild Our Economy

Paul: That doesn’t mean we can’t make plans and do things. And frankly, it’s going to sound cruel because we’re all so injured by COVID financially, and most of us, lifestyle, including my family. It’s going to be an exciting time to watch it rebuild, the rebirth and rebuild of our economy.

And quoting Emmanual a little bit here. Maybe a rebuilding of how we treat each other and how we care for each other and how countries look at each other.

Which we were really getting to. I mean, China was the Cling-Ons, in most of my lifestyle. In China, my dearest friends, I love going there the most. Wharton and NYU, my two schools that I teach at, both built major campuses. I’m an adjunct professor at NYU Shanghai and I never thought this in my lifetime. They were these evil people that were fighting my wife’s family in Vietnam. And now, we’ve made them our best friends.

We yell at them, “You crazy Chinaman why didn’t you ship the goods last week? When are you delivering? You’re no longer threatening to kill him. You’re threatening to get more deliveries and pay them more money. I think we’re going to return to that even in a better way, again, based on COVID letting us go back to hugging and loving each other.

Niurka: Awesome. Thank you Paul.

The Banks Roles in the Economy – Will they give loans, credit?

Niurka: What is your take on the banks’ attitudes of deploying capital on current deals in the pipeline?

Paul: Great, great. Great question. And there I feel comfortable. The 1st thing I have to define is what is a bank? A bank is something that I, I’m an ex banker. I got my first job outside of Wharton, at Citibank and rose up to be assistant to the guy who’s running Citibank and I’m still very active with Citibank in all my businesses. And Citibank back then was the largest bank in the world and still to many degrees in many areas is. A Bank is a facility that you put your money in as a depositor. And the example, Chairman ….. Used in my time is: There’s a little ol’ lady who’s got a grandson and she wants that grandson to go to college. And every week she shows up and she puts in 50 bucks and she’s done the math. We showed her that you’ll have $20,000 saved up when he’s 18 and he goes to college and that’s our customer.

Now, if I take that money and invest it in your business, show me how the little old lady gets it back. And wisdom would always tell me, tell me about the little ol’ lady. We’re not trying to make money in those days. Banks, we dreamed of making a loan at 6%. We took in deposits of 4% and 5%, and we lent it out at 6%. The important thing is, all of those loans had to have what I call the Management by Death Pass.

That means if everybody connected with making the company died, Emmanuel, excuse me, you and your employees or Denny and everything bad happened, the little old lady still gets her money back. Cause, we- the bank, collected. So we only lend on assets that will turn to money -turn to cash over time, but you have an inventory and something I can put a lien on. I know I can go after your house, get the title, sell the house and I want a little cushion at 28%, that’s what a bank is. A bank is giving you money on something that will turn to cash by itself.

Unfortunately, banks got into what equity people do, venture people do, that are dependent on Niurka getting up every morning and coming up with a new plan and doing all these new things. That’s not a bankable loan, which is why you don’t have a lot of bank debt in your business. I’m going to guess, because nobody would lend it to you cause they said if your employees all die, and you die, I’ll feel bad for you, but the little old lady doesn’t get her money, cause we don’t get the asset turn. But if I lend on your shipping containers, on your gold, on an asset, or a house, that turns -can be turned to cash without your expertise- that’s a bank loan.

So the first thing is the banks, as we call them, lenders. I never got to give anybody a line of credit. And if they were going to give them a line of credit last month, Christa was so strong, it’s not happening. And it’s very sad to me to think…

Niurka: Unless it’s collateralized.

Paul: Collateralized by something that turns to cash if everybody dies. And I used to lead my meetings at Citibank and my boss would say to me, “So tell me, let’s go through the death test. If everyone in the room, including you, Paul, including me, died. How does the little ol’ lady, how does the bank get the money back on this thing we collateralized? We’d hire some guy to take it and sell it. I have a cushion. We get back 70 cents on the dollar and guess what? That’s what the little old lady had.. So that’s a bank.

Now separate functions of banks are things like becoming the currency in the world. I mean someone needs to pay for something and if 2 of us ever agreed to,”Gee, I’ll come to your seminar. I think I’ll get $20,000 for it in my business by being there. You’re charging me $1,000. I’m sorry if these numbers are way off. I’m thrilled to pay the $1k and earn $20k that’s, but then once we agree there’s something else, how do I get you the $1,000. To get you the $1,000 now, (Sorry I’m looking at you over there and she put your head over here) to get you that $1000 we got to figure out pay. Do I give you apples? Oranges? No. You’ll take a swipe on my credit card.

Those are provided by banks and electronic companies that do transfers of funds with reserves. And that stuff’s real ‘scary’ cause if the bank goes out of business, doesn’t have employees to fix, they can’t move it. They will fix it over time. But the Depression quickly became a cash economy.

Checks stopped. People walked in, they didn’t trust the bank. You got to walk in with piles of cash to go get your corn from Seedcorn. Nobody was going to trust you writing a check in 1932 or ‘33. So with ‘scary’ and what my expertise right now is focused on, and the people I know, we have to keep the transaction part of banking flowing and flowing in a good way; because without that, it would take you 2 hours to make a sale if somebody wants to come in and be at your seminar. You’ll never figure out how to pay if you don’t have a debit card or a check. If you’ve got to start arguing about apples and things in your house and how are you going to deliver it. So, a banking system means a big thing for transaction and function and the banking system for loans, which is really not going to happen.

Government Bonds: Keeping the Banking System Alive

Paul: And right now it’s the banking systems focused on just staying alive. I mean, we are saying such ‘scary’ times. I believe that secretly right now, I don’t like to use the word secretly, but I feel it. The Fed is buying, not just government bonds when they come to Christa.

I have a government bond. It’s $10 million. I go in somewhere to get it turned in and no one wants to buy it. So I want to sell it and turn it to cash. There’s nobody out there. And I’ve heard horror stories where people go to their bond funds, click on them to say, ‘Sell $200,000 of this so I have cash to meet payroll.’ And guess what happens? Nothing. You think the clicking is wrong. It doesn’t show, you see the price, you see the volume of transactions. And you say, I want to sell this stock, sell this bond; it doesn’t sell.

One of the scariest things in my life right now is I’ve lost huge amounts, millions of dollars in municipal bond funds. Now think of that. I take my money, and I’m worried. So years ago I took a significant part of my net worth and I buy Muni bonds. That’s a bond issued by the city in New York, or Podunk, Iowa, or a little town. And the municipal bond funds or I take a hundred bonds, put it in a fund, assuming they’re all $1M, is $100 Million. If you do nothing but sit and wait for time, guess what they become? $100 Million cash, cause the bonds come due and the city pays it off. Well, guess what’s not happening? The bond funds are dropping to 20%- 30% drops, meaning they’re selling for 60%, 70%, 75% of par. So you have a bunch of bonds, which are IOUs from governments that are saying, I’ll pay you $1 million. The bond should never go less than the par value, and they drop below par, which is really frightening.

Now, one explanation for that is, “it’s not that people think the municipalities, Paul,” that’s what I said. I’m on one of these calls like this. I said, “The municipalities are going to go broke.” People smarter than me, who have time to go through each city, in each state, or say these states and cities can’t meet payroll. You don’t meet payroll, you don’t have police, you don’t have fire, you don’t have anything. And most of their expenses, by the way, are payroll and pensions. It’s a huge mess when you think of these municipalities going broke.

The alternative view, which I’m currently clinging to like a life raft, is that these bonds have not fallen cause people think they’ll default. They’ve fallen because people are desperate for cash today.

They know they can sell it for cash and they want the cash. I mean this hour. Now, the market is dropping by the hour in many places. So they want to sell these bonds and turn it to cash now at 10:00 AM. They’re not willing to wait, and then they got to wait 3 days for settlement and the security. They’re not willing to wait. So they want the cash so desperate that they’re willing to take a 5,10, 15, 20% discount. And that’s why municipal bond funds are selling well below par right now. That is the scariest thing in the world because what a person does, when the world crashes is: you have stocks and bonds, “Uh Oh! I think it’s bad. Let’s move more stocks to bonds.” You click on the money and your bonds dropped 20%. That’s happened to me, by the way, in 1 day, and I thought it was an error on the computer screen.

Niurka: Now does that bounce back?

Paul: Theoretically. They theoretically should. And that’s what I had a long talk with some very key officials at Vanguard yesterday. I don’t know. They’re not gonna tell me it bounces back cause it may take a long time. I personally believe cause I don’t believe God is ending the world, which if it doesn’t bounce back, the world gets a lot rougher. We’re still dependent on calling 9-1-1 and getting help. But 1 of the things, I have good news. I’m setting up ticklers on my system that when the bonds start going up, not only will I be holding still in my municipal bond portfolios, I’ll buy more. Because I believe they will come back to par. And that’s exactly what happened in 2007-8 municipal bonds fell to $.80 on the dollar, $0.75. I can remember the date all the Illinois bonds fell to $0.75 because they felt Illinois would default. A default means no police, no fire, no services, no schools permanently. And it came roaring back like in a very short couple of months. So, and again, I’m going to make mistakes this time as an investor based on the mistakes I made in 2007. What didn’t work? And that doesn’t mean I’m right. But I’m wounded that way. So I keep repeating the same one. I’m sort of rambling here if you’re following it.

Niurka: So, so in looping up that, that question that as far as banks deploying capital, as long as there is the collateral to back it up..

Paul: Which doesn’t exist. There is no collateral. If it was collateral, yes. Show me what anyone here as entrepreneurs you’ve got in this table have as collateral besides their house and that house might be worth half as much. They’re thinking the house is worth $2M cause they paid bought it for $1.5M and it was appraised at $2M. It may be worth zero, it may be worth a $100K or it may be like the municipal bonds, those who want to buy it, want such a discount to buy it cause their opportunity in the recovery is so great that they take money and turns to his family and says I’m buying a house. They go, no of course, I’m buying our money in recovery versus a house. They’re gonna skip the house. In other words, there won’t be capital to buy homes.

Effects in Real Estate

Niurka: What’s going to happen in the real estate industry?

Paul: It depends on the..it all comes down to biology again, it depends on the time this thing lasts. If this goes away in 1, 2, 3 months, real estate industry is pretty long term. Now I own and control, I’m on a board, and I have personal investments in senior housing. We’re an exciting billion dollar, multi-billion dollar senior housing business. Would you like to buy one of my projects? with a hundred seniors living in it today? None of them have had any problems with COVID. You want to buy one? So when you say real estate, you have to say, which real estate.

Let’s take Retail, I’ve already been talking to on a call yesterday with Big Box. By the way, I’ve had some really good calls, so watch this one. On one of my Planet Fitness gyms, I have the list of people I need to call and one of them is, I’m learning this and I have this as a chapter in one of my books. Tell people in advance the worst case, just take a deep breath because then you’ll be friends when it’s not as bad.

So, before I’m ready to call one landlord, he called me yesterday and he said “So Paul..”

I said, “I owe you a call.”

He says, “No, you closed your store. I drove by and I saw the Planet Fitness was shuttered.” Which is a violation of the lease. The lease says it accelerates and I owe all the payments at once if I closed the store. And he called me and he said, “I saw it closed. I’m kind of worried, but obviously you were ordered closed. I read.”

I said, “Yeah, I had no choice. And I meant to call you and tell you I closed.”

“What do you think you’re going to need financially?”

I said, “I don’t know. I have to make some assumptions about the biology of the virus. And then..”

“I’ll tell you what. I know you’re gonna need something. So you owe me $88,000 rent this month coming due on April 1. Don’t pay it. You probably have a better use for that cash.”

I say, “Thank you. I’m going to keep my employees for a month, 2 at least, to see that. Otherwise, it’s not going to reopen if you don’t keep all the employees on staff.”

He says, “Just defer. I’m not giving it to you. I’m lending this. Give it at no interest. Pay me when you can pay me.”

I said, “Look, let’s assume it comes back fast. How about I pay you on May 1, the April 1 rent.”

He says, “You’ll pay me April 1 and May 1 rent on May 1?”

I said, “Yes.”

He said, “You’re great.”

I said, “No, you are great. You called me and didn’t argue with me.”

He says, “Paul, I need to keep you in business. I don’t know how to do that and I don’t have the money to do it cause the money I’m not getting from you in April. I got to give that money to the mortgage lender, but I already spoke to the mortgage lender before I made this call and he said, let’s find a way we can cut his rent 25%.”

I mean, these are great things, so they’re already anticipating at the mortgage level that they have mortgages on properties that have tenants and this thing. Nobody does any good if we kick 10,000 members out of just one Planet Fitness store, let alone this 2,000 of them. We’re all in this together and everybody’s going to have to work together. And ultimately someone’s got to take the hit, and the hit is going to get taken by government.

Government’s going to sponsor huge reductions and mortgages. It’s already started.

How the Government Will Step in to Save the Economy Until It Recovers

Government in the U.S. is about to send everybody $500 a kid and $1,200 cash. It’s the latest proposal just here, just to keep them breathing and having the food while we figure out what we do.

Government in the U.S. has already proposed. You come in with a pay stub. And here’s the interesting thing about entrepreneurs. Do you remember the BP fallout I put time into? BP was the oil crisis in the Gulf of Mexico and Gulf of Louisiana and that gulf spilled oil and the government stepped in with billions of dollars. Fined BP took the slush fund, I think it was $120 billion and gave it to the entrepreneurs who lost money. So a typical entrepreneur was money was a guy who owned the restaurant, he’s not in the oil business, but his whole business was the dock where he sold the best shrimp sandwich to the people that went out on oil rigs to work.

It’s a huge industry and now he got hit because when BP Oil Spill came for a year and a half, there was no commerce. So the government said, we will make up your sales, but only on your tax return. Meaning you walk in with your tax return, you show what you earned last year. Government writes you a check. They’re great. I think it’s wonderful. But if you had cash and didn’t report it, because all these people down there, a lot of them, it’s a cash economy. You’re not getting a penny. And the government made a big decision and if the guy took the lunch money, $5 and put it in his pocket or under his mattress or paid another vendor with cash so they could hide it for not paying taxes, those people, the government, the US Government said, we’re not going to pay you. You must show bank deposits for your sales, credit card receipts, and we’ll give you that.

That’s exactly what’s going to happen here. I know that ‘cause I attended a meeting, bankers and government regulators, and we’re going to come up, we, I’m not regularly, I’m an advisor here. I’m not making the decision, but the decision will be to pay people what they lost in revenue. So a small business who is doing $8,000 a month, in a little bodega selling some kind of food. If he could show receipts for the $8,000 a month, right now, government could change. There’s a good chance the U.S. Government, the IRS will say, here’s a check for $8,000 a month ongoing. Or if we’re closed for 5 months, because that’s what you lost through no fault of your own.

Niurka: You’’re saying that the government would subsidize their gross revenue for that month for these small businesses?

Paul: That is happening right now. Right now we are arguing in Congress and in the United States how to do it. Not if we should do it. That doesn’t mean we will do it. But right now we’re figuring out what are the mechanisms to make that happen and we have evidence of this when we did use the BP oil spill. In their case, we got a check from them, a big check of $100 billion, whatever the number was from BP, and then we gave it to the people, not just oil drillers. Anybody in that economy who got hurt, cause we said BP paid, in this case.

Niurka: For what period of time?

Paul: What you lost till it recovered and it took like 5 years to recover. This takes a while, which means you got to give him payments like here’s $1,200 today. You know, they’re literally funding that money now you got to get money to buy food. They have kids, they’re hungry. You have to have some law and order and people get very testy when they don’t get fed or their family doesn’t get fed.

The scariest picture I saw, I don’t want to be the negative about any of this. A friend of mine sends me a picture of Costco and I said, “Gee, the line doesn’t look so bad. Should I run over there and get food?” He says, “I wasn’t sending it to you cause the line, look close. Half the people at this angle had a gun on their hip.” And the reason is you have 2 kinds of permits. You have a concealed carry permit, which is harder to get, a hidden gun; and an open carry permit, which means you’re not hiding it and the open carry, most people can get. So they just carry an open carry gun. That really threw me. Nothing’s going on bad. Nothing’s happening. A lot could be said. Our president and a lot of people believe we’ll have law and order because of these people.

God bless them. Like school teachers carry a gun. So I’m not making a comment on guns for or not. I’m just making, I never saw a picture of Costco shoppers in line, lined up at the counter and I never noticed the new fashion element was a gun on their hip, of like half these guys I saw on the line there. So it’s going to be very..

Niurka: What is the timeframe on a decision like that from government to subsidize small businesses?

Paul: Days. I believe this week we will have it go through, right now based on my calls, which are adverse selection, some people call me to talk about it. Some people don’t. Based on people I’m talking to, I believe within a week they’re going to hand people checks. The $1,200 the last proposal was if you have a tax form electronically, they can look up your number of, if you’re in less than $98,000 we’re going to give you $1,200 a person and $500 a kid and that was as of 2 or 3 days ago.

I’m gonna.. I mean that check’s coming to you now. It’s going to the mail or it’s going to get deposited in your account and then we have to figure out the mechanism for it. That’s not a lot of money, but it helps people making less than $90K. All the proposals I saw till 2 days ago, but everybody gets the $1200 check. They give it to the rich people. Now who’s going to pay for this? The tax payers, the richer taxpayers are disproportionately going to pay this because we have progressive income taxation. So the more you make, the more you’re going to pay, but it sends the right message and it keeps things flowing. The next item, now you answer your question more directly is what are we going to do for small businesses and they’re all talking about subsidizing small business revenue for some period.

Niurka: But this is just U.S. We’re not talking Canada.

Paul: Yes, just U.S. Now the small business revenue I already saw became political. Nobody, everybody was unanimous or 98% 95% I think grandpa was the only Senator who voted against the $1,200 check. Nobody its changing by the day when it comes to giving people small businesses money. What’s a small business? Is it a business that does a $100K a year? $1M a year? and it very quickly became political. The Republicans say all small business deserves this. You shouldn’t penalize a small business cause he grew his business to $1M a year versus $500K to a $100K, he’s just got bigger problems: more payroll to lay-off. Give him the same amount of money. Wrong. The other side of the aisle is saying we don’t care about the guy who is doing $1M a year. We care about the guy doing $100K. Which I think is shortsighted, because both are going to lay off people proportionate to their sales.

But these are the questions we’re doing. I will say I’ve never seen this much cooperation on both sides of the aisle in Congress in the last 2 decades, probably 3 decades since the Reagan administration when everybody hated the other side. I’m seeing real cooperation at least under discussion, not on the output. They still want to penalize the larger small, midsize, small business. But in terms of debating it and being civil and figuring out the economic impact. And ultimately, if you think about it, the government is bearing all this cost.

Means, we’re going to pass on the cost of this bailout to the people based on their networth or based on their income. So somebody’s gotta go, you go through my chain at Planet Fitness. There’s my member, at $10 a month. We’re not billing them anymore $10 a month. That means I have zero revenue on each gym.

So does any other business. I gotta pay a landlord. I stopped paying any. He stops paying his mortgagee. The mortgagee stops paying his shareholder, who bought their shares from Schwab on a fund to live on, to get an annuity. You start to see the chain. At the end of the line, I believe, needs to be the government doing a stop gap and saying, we’re going to eat this expense, which means we’re going to pass it along to everybody else. And that’s why the 1st bail out proposal was a trillion and a half dollars. Now they’re looking at trillion dollar bail outs left and right, and then we’re going to have to pay all this back in some, in some way. Good news. The U.S. economy is so unbelievably strong and here, I mean US and Canada, it is so efficient and it can be made so much more efficient by technology we’ve developed, ready to roll out.

And as I’m sorry to say, the rest of the money that’s around the world is flowing here and it’s flowing to the U.S. because they believe we’re stronger militarily and we’re stronger politically, then the country they probably come from. And there’s always a rich guy in Malaysia or some or Indonesia and he’s worried about his family and he and his wife are putting that money in the U.S. so the U.S. is going to come back very strong or let’s call it faster than anyone else and we’ll survive this massive amount of bowery cause it doesn’t do us any good to close our retail stores.

Technology is Going to Bring Big Changes to Retail & Politics

Paul: Now, by the way, I got off on this when I talked about retail, Big Box Retails not coming back as what was happening in retail before this online. Look at your lifestyle, how much you buy online now and every once in a while. I just bought my cat food online 3 months ago. I haven’t stopped buying cat food. It’s so convenient and it’s cheaper and it shows up at my door. And cat food, really, it’s really hard to carry cat litter and cat food, and so all these things now, Big Box Retail was already in huge trouble.

Well there’s, there’s going to be no tenant coming back or the tenant’s going to come back and say I had 20,000 feet, I now need 10 or 5,000 cause most of my sales are online. Cause you’re gonna have to let them out of their leases and we’re going to have to rebuild and these are going to be rapid changes in the economy.

What Joseph Schumpeter called Creative Destruction. Joseph Schumpeter is my favorite economist. I base my work on and the whole Reagan Administration economically was based on it, and he created a term called Creative Destruction.

Globalization: The ability to trade with everyone else leaves more people to compete for your products and services you want to buy. And what happens is, you buy cheaper and cheaper products that are made better with technology. What does that do? Puts lots of people out of work, because people who had a job where you buy something cheaper, that plant that you bought it from, probably employs 5 people. Whereas the other plant has an old method employing 10 and we call the old method being destroyed Creative destruction. It’s a great term.

What happens though is he said the creative destruction he coined in the early 40s and made his career on, it eventually puts so many people out of work that the people vote in socialism. We certainly saw that in the American primary in the last few years. We had a socialist candidate leading the pack for a while.

Announced socialist, not someone who I’m saying, Hey, you are a socialist. I am a socialist, is Bernie Sanders and he was the leader because so many people are put out of work by new technology. Read that as Globalization is the accelerator on new technology because you can buy it somewhere else and that was happening anyway. That’s now going to happen so fast and it may change our political system in a big way.

And you might argue that socialism is, I’m rambling here a little bit, Socialism is the right term for an economy where the government bails everybody out and tries to get it back. Now, historically though, we have some great precedents here, the government bailed out GM. Everybody, we were right down the middle, split. Obama was the president, he rallied the Congress, which was democratic men and they bailed out GM and all the Republicans went crazy.

Now let’s get a little more specific. I wanted GM bailed out cause I wanted to see all electric non-polluting cars. I said GM can’t do it. If we closed GM, Tesla will buy those plants and all have enough non-polluting cars. But most Republicans didn’t want the bailout of GM cause it sounds socialist. Well guess what? In 3 years, GM paid it all back with interest. That turned out to be a great deal for the government. GM bailed out. The U.S. Government bailed out Citibank and Chase and all these banks and everyone said you can’t do it. They’re the criminals that caused the problem. I don’t agree with that, but that was the view. But you had to bail out the banks because you needed your credit card to work and you needed something if you were buying an asset. Like a farmer with seeds that would turn the cash in four months, you needed to borrow it out. You needed a line of credit and if we closed the banks, all that would stop.

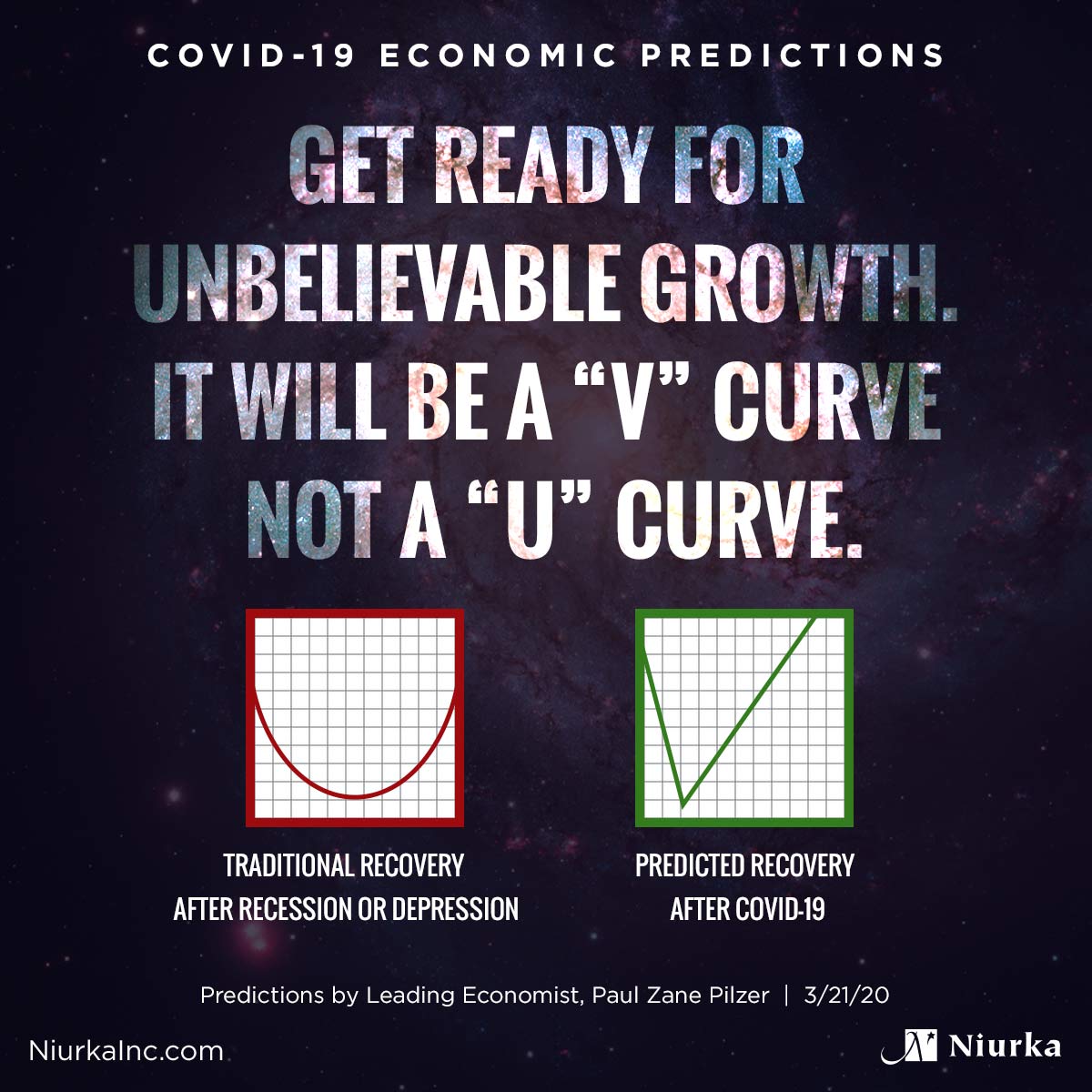

Well, we worked through the system and all the “socialists” decisions made in 2007 and ‘08. I’m embarrassed to say this as a Republican, they worked. I mean here’s, yes. We gave these guys money, and guess what? They paid back every penny with interest and it was, and they’re all running now privately. We’re gonna, we have good precedents and evidence of government stepping in. Government needs to make the right decision and the devil is in the details. The devil is in the people who have backgrounds in finance to figure out how to keep the banks alive and more important the banks business flowing to the private customer. As we rebuild this cause we’re going to rebuild it so fast. I said the ‘V’ like the ‘U’ that we’re going to need the banking system, everything working really quickly.

Niurka: What do you see happening with construction?

Paul: I think thats just one of the first ones that dies because new construct, well the key is every product, projects gotta be looked at. Do we continue funding this? Even if we have to leave it empty. Now I know after 2007 and 9/11 we left a lot of projects just half built. Told the city and state it’s unbuilt, big deal, unsafe, and then picked it up 1, 2, 3, 4, 5 years later. All that’s gotta be decisions that got to be made and we need to have our municipalities alive to make those decisions.

Solving COVID Will Mark the Turning Point in our Economy.

Niurka: So, that goes back to when is this going to medically be solved? What is the answer to that question? So,..

Paul: I’m still hoping now that my number one worry has been my son with COVID. Yesterday that got solved at 2:13 PM. He doesn’t have COVID. My family’s clear. Now I’m focusing on my #1 problem and the #1 is going to be: When does this end? And I’m still clinging to this thing goes real quick, that somehow we get control there.

There are probably 3 things now. I should say there’s:

– We solve the problem of contagion– People transferring it to others.

– We solved the problem or we solved the problem of making it not a big deal. Cause even if you’re old and you get it, we have a drug now that cures it.

– A 3rd one would be we solve the problem from some combination of both and it gets solved next week, or in 2 weeks or 3 weeks.

Where we roar back then, because most people are still paying their employees 2, 3, or 4 weeks because they are still clean.

It’s sort of like hope. I don’t have an answer there, but if we’ve solved this quickly, there’s a real opportunity to make a lot of money in the next month, assuming we solved the biology in the very short term. But again, I don’t have, you know, I love being an economist, not a biologist now.

Niurka: Beautiful.

Types of Government from the Fallout of COVID 19

Paul: People of my generation are running around saying, where is Mussolini now that we need him? And the reason for that is Mussolini at a time that the only big commerce, a way to get around, was trains. And the trains in Italy vs. Germany and the U.S. are terrible. They didn’t come on time, they didn’t come at all. And Mussolini ran and became Mussolini by putting in law and order to force the trains to be on time. He unfortunately became Hitler’s best confidant, and a dictator. But that’s where we are right now on China.

I have been very active in China. Most of my revenue and work comes from China, for the last 2 decades. And in China each time I’m there, I love their system because they fully understand the Star Trek motto: The needs of the many, outweigh the needs of the few. And just say that 3 times. The needs of the many, outweigh the needs of the few. And I used to think of that as a little cute thing when I was 12 years old watching the original Trek series. That’s what this comes down to right now.

China understands needs of the many. China understands they have a criminal justice system that I think is wonderful because it’s focused on the victim. We society screwed up at, ‘This guy killed this guy. We need to make the guy who got injured whole.’ Not so much punish the guy which will do/cause the crime. And I’ve looked at China and they didn’t think of us, my Chinese friends, whenever they visited America, they look at us like crazy.

How do you live in a city? I once gave a speech to a great hall of the people and we walked out all at once with Wen-Jab, the Premier of China and my handler who was then their Health and Services Secretary said to me, “we watched the Premier run over to a group of old ladies break from the crowd, hug these old ladies who saw him and made eye contact.”

And when he went to do that, the Premier of China, my handler says, “Paul, look at this. He’s loved by the people of China. I’m told in the U.S. if Obama walked out on the street one day just to get a walk and started hugging people randomly in Washington, he’d be killed.” And I said, “Probably they put out the word that he’s walking unarmed down the street.” And he thinks of our system as barbaric.

And right now the Chinese people who all went back to work 10 days ago, one of my morning calls each morning is to call my employees and people in China and see what’s going on. How do you feel? And all of them almost universally I’ll rattle off, ran to be with their parents cause they’re mostly single child families, which is another whole issue. They ran to be with their parents. They stayed with their parents 2, 3, 4, 5 weeks and now they’re back to work.

So they’ve returned it, and they think we’re crazy that you couldn’t tell an American, I’m going to put an armed-guard at your building or on your neighborhood and not let you out till you tell me where you going and bring me some evidence. If you’re buying groceries, you better come back with the groceries. And we all obey this not because they’re going to shoot us, because we think it’s a great thing to do, that they could stop contagion that way.

Excuse me, and the cough, I have to warn you is I drank my coffee too fast. Not that everyone’s thinking I’m going to contage them through the screen. In my bubble, we’re looking for Mussolini. We want someone to tell us what to do based on science and tell us what to do and we’ll obey it and we’re staying in. And I live in a total lockdown County, which is the worst County for Coronavirus in all of Utah. We have more, more contagion right here in Summit County, Park City. It’s a ski town. And the reason was, we have population of 7,000 people and 50,000 tourists coming to ski. Excuse me. So I don’t know where the answer is, but we may at some point take a Mussolini here.

Guest (not sure who): I have a quick question. So the quick question is this, you spoke about how essentially large scale social programs were put in place via GM and now we’re looking at possibly one of the most massive social programs that will ever be enacted. The interesting political question on that is then, is how right is Bernie Sanders about his proposals on socialism to lift the country out from where it’s at?

Paul: Yeah. I don’t have an answer on Bernie Sanders. They do have a good positive though on Bernie’s side is that the real issues right now are we needed last week to get $1,000, $1,200 to every adult who earns less than $90K, or I would’ve said to everyone. Just to have them buy food, and it’s not really political. Right, like who pays the right taxes and whether we have a common payer in medicine. It’s more like, people need medical care in the short term. There’s a guideline in the emergency room. How do we get money there right away to fix that problem because ultimately the nurse is not gonna work late if she doesn’t have money to buy food for her kids that night. And it’s really gonna come down to what’s the most efficient form of government in a crisis to get people urgent care that they need. An urgent care is food, money, place to live, safety, police. Start thinking of everything that could decay. It gets very scary and I don’t have an answer to that, but I now have a new metric to gauge my politicians.

That’s why I use the example, well most of my friends, are all looking for Mussolini. We’re not looking for Adolf Hitler, but we are looking for somebody to take control and figure out who should be arrested in LA and going back to Niurka’s comment of arrests going from 300 to 60 and what’s fair and unfair for the short term, and then from that we’ll rebuild a lot of the long term.

Ultimately in this comes Good, because we rebuild and we reevaluate. On what, and back to the example of arrests, Niurka, certain people you said, who shouldn’t have been arrested in the first place, are not being arrested. So when we put back in the arrest systems for the bad guys we’ll probably maybe think, well we don’t need to go get the good guys yet or the guy smoking marijuana and put him in jail cause he lives in a state where it’s illegal.

I’m not saying we’re going to make these, but everything is up for grabs, and everything comes down to which form of government is the most efficient. But people don’t understand when I read Karl Marx and all the communist ideologies, they were all economists and they were written about efficiency. They were all Karl Marx and all, they were all written as these are what we need to do to distribute goods and services to people. And we’re going to be analyzing that short term right now to keep things flowing. And then as we rebuild, we build long term. It doesn’t mean we’re all going communist, it doesn’t mean we’re all going fascist, but it means short term, we have a lot of tough decisions to make and try to keep ourselves going. And I believe in the survival of the U.S.

I love this country beyond any, I can’t even begin to…, how much I feel as a former government official and as a refugee here, not me, my parents are refugees, how much great I feel about the U.S. So I believe we will survive, but politically it may involve taking more of a Chinese stance, which is more Mussolini than a

Niurka: short term

Paul: Or longer term. I happen to think China’s view that your premier should be able to walk down the street and mix with people. That’s a good thing. Why shouldn’t the President of the United States be able to walk down Connecticut Avenue and talk to people and ask how they do. I think that’d be a good thing. And that would be a goal, for we’re going to clean up our streets, or our people, or use technology, and get are, using 1 example that the Premier can walk down the street and talk to people, because the Chinese think we’re bizarre. They can’t.

Niurka: Thank you so much Paul. We are really grateful for you being here. And I know that you have another call coming up. So I’m just going to ask a few quick, and maybe you could give quick responses on this as final questions. Is how about the stock market as far as investing? Is there, you know, when would be a good time or what are your thoughts as far as investing in the stock market?

Paul: I’ve always called that 1 wrong. So everybody’s gonna have to look at the news and make their own thing. And it’s not a question of accurately, accurate on when. Remember the stock market is not the predictor of the economy’s recovery. It’s the predictor of when people think it’s recovering. So when people start thinking it’s happening, there’s going to be a huge opportunity to do nothing more than just buy equities or buy stocks. I’m personally buying more muni bond funds, which are down 20 cents on par, which is really crazy because I can’t, in my lifetime I always bought muni bonds at premiums that paid 101, 102 and now that I combine discounted, I’m going, ‘they got to come back.’ That’s just me. I could be very Rush, and he was wrong the last week or 2, cause I started buying him when they went down to 5% 95% of par, meaning somebody said a million dollar bond is worth 950 and now it’s down to 800.

It’s really scary. But the stock market, is really the scariest thing. I saw this morning. I went and looked. How low did it go in the Depression? And it went to, it’s right now it’s about 60, 65% of par. Meaning the market in total is trading for 65 cents on the dollar, which most people have leverage positions in that they’re wiped out. The market, stock market, equities, same bonds, same stocks in World War in 1931-32 hit their low point and they hit 20 cents on the dollar. So the market dropped 80% in the great depression. Our markets dropped 45, 40%. Now, the scariest thing in the market today is when you want to take your money out of equities, you can only buy bonds and the bonds are down 20%, which is phenomenal. Like all the rules, everything. Why did I want to work in business school?

I got an MBA to learn how to do these things and everything I’ve learned that has served me really well in understanding how markets work, stock markets is gone. It’s like they dropped me on a new planet, in the last week, and there’s no gravity, and I haven’t heard and they told me to swim, and I don’t know. How would you swim with no gravity? I don’t want to answer that. You have to think it through. And that’s what I’m feeling like, I’m lost completely because the rules are no longer the rules. And that just happened this week. Sorry to scare you on that in the market you had other questions.

Niurka: How important is it for, we talked the other day as far as like how much is insured in particular account? Are you okay, if you have more cash in the bank than that? How important is it to put money in two separate banks, for example, as opposed to just one?

Paul: Right. And that’s a great example for a small business person. Definitely put it in separate banks or put it in another name. Someone you trust or your spouse. There’s 2 legal taxpayers on the name and this is U.S. You get $500K, if 3 people have a joint account, in some cases you get $750K. Insurance doesn’t go forever, by the way, but some number of depositors you put as the co-depositor with you, you get more insurance. Now if we ever hit that level that insurance is gone, I believe there’s blood in the streets literally and figuratively, so I don’t think we’re going to hit there. What we did in 2007 is we upped the limit from a $100K to $250K then in 2008 we said everybody’s insured 100% on any checking account, meaning it’s millions to all commercial banks and we did that because there was no way to keep the system alive cause $250 sounds good for your average depositor. People like me, I got $250K and 20 accounts.

They’re all little business things and I got them all with the same bank that knows my business. I can’t just pull them all out to try to get insurance. So the $250K doesn’t help business people who are small business people, like Planet Fitness Gyms franchise owners. It doesn’t help the franchisees. It doesn’t help individuals. It’s too small of an amount. It sounds good and you certainly should put money in the bank trying to get the limit in your favor and I did it of course made sure my spouse or I are on this so we get $500K coverage, but I don’t believe we’re ever going to hit that because I believe they’re going to insure all banks like they did in 2007 it’s interesting to look at here and I haven’t completed this, is all the things we tried and did in 2007 and 2008 we’re probably going to do again; cause that’s some fiscal stimulus we know.

The problem we’re facing is we’ve never had an economy in the history of the world except Wars that went to zero and it was always the loser. The economy Hiroshima went to zero. That’s a very unusual example. When the bomb hit and even Hiroshima got rebuilt. Our economy not only is going to go down, it went to zero overnight. Normally a depression means a depress. Think of it. I go to a wall and I push in, right? This is a depression in my thumb. It’s not a wipe out. The whole wall fell apart. That’s what this is. Everything ground to halt to zero and so we don’t know how the depression, you know how to grow. You’re at 50% of sales and may grow back to a 100 but we don’t know what to do, all based on the biology.

Niurka: Wonderful based on the biology and that we know that once we hit that bottom, we’re going to come up like a V.

Paul: Yes.

Niurka: I want to thank everybody for being here. Paul, thank you so much for your time.

Paul: Thank you for your questions.

Niurka: and being gracious in this essential conversation. Again, gratitude to everyone and we’re all in this together. We will keep the conversations flowing. I want to thank everyone. We’re signing off with much gratitude and much love. We’re all in this, in oneness together. We’ll be in touch.

I’m intending that you enjoyed and received profound value from Part 1 and Part 2 of our conversation with Paul. I know that I absolutely did and even though things are challenging in this time, know that we will quantum leap forward with greater clarity and strength than ever before.

So please be sure to share, like, and subscribe because it’s essential that we spread this news across the globe. And also, if you haven’t already, please be sure to give us a five star rating if you enjoyed it, I’ll be so grateful that you did and be sure to tune into our next episode because I’ll be having a conversation with my dear friend Michael Beckwith on spiritual liberation.

I will see you there.

UPCOMING EXPERIENCES

A 2-Day Total Immersion Training Experience For Achieving Results

July 26 - 27, 2025

LIVE VIRTUAL

Nov. 7 - 10, 2025

LIVE Virtual

July 23rd - 26th, 2026

LIVE Virtual Experience

March 4 - 7, 2027

LIVE Virtual

June 23 - July 1, 2027

Bali, Indonesia