This is Part 1 of a 2 part conversation with world leading macro-economist, Paul Zane Pilzer as we discuss Economic Projections over the next 10 years, including the recovery and rebuild after Covid-19.

SEASON 1 🎙📻📺• 🎬This Episode was recorded on Saturday, March 21, 2020. , MARCH 21, 2020. For More Visit: https://www.TheSupremeInfluenceShow.com

Be sure to tune in to Part 2, which airs tomorrow.

SHOW NOTES

- Everyone will remember this epochal event, like where you were on 9/11. The start date may be different for each of us. It could be the day a loved one was lost to COVID-19, or the day they logged into their securities account and ⅔ of their 401k was gone, or the day they lost their job.

- Don’t leave home without $500-$1,000 cash in case there’s a break in the Bank System Chain.

- Be prepared for the economy to hit bottom, and know that we will recover from it stronger than ever before! We will solve this problem.

- Positive Aspects of this challenging time include: Generating money – this could be a good time to invest when the market drops.

Niurka shares: people are returning to being present to what’s most essential. It’s like a recalibration of our entire world as paradigms are crumbling, creating space for new births.

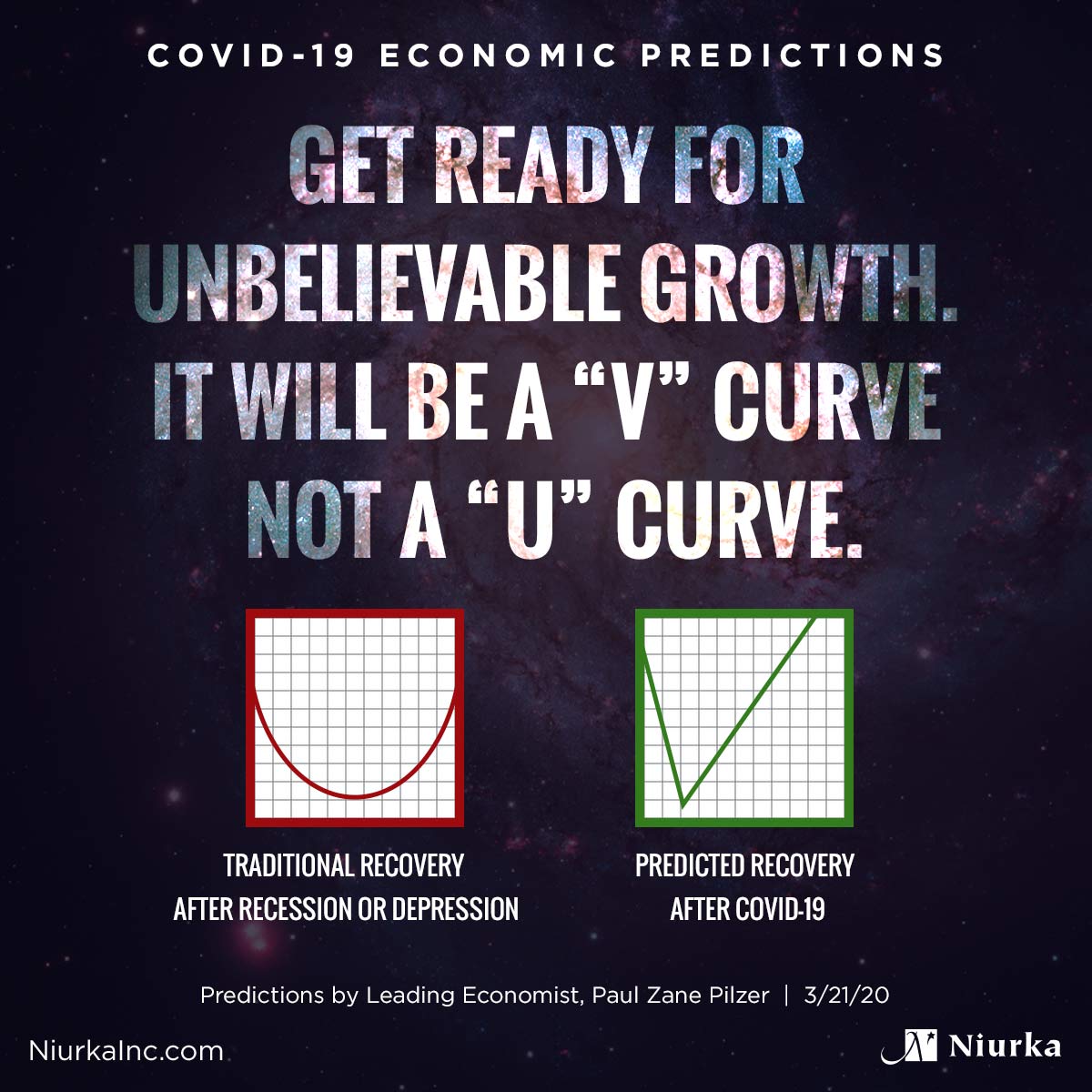

- Get ready for unbelievable growth. It will be a “V” curve NOT a “U” curve. We are going to rebuild our economy at an incredible, fast speed. Paul anticipates 50% growth in the economy in 9 years in his new upcoming book: “The New Roaring 20s”. Unemployment will also grow, but people will experience a better quality of life due to new technologies.

- John Maynard Keynes, the Greatest Economist of the World, predicted in a letter to his grandchildren in 1927 that, “By 2028, we are going to be so rich as an economy due to technology doing all the work.” Also, opportunities for those who want to make money will be unlimited.

- We will begin to think of the world as BC and AC: Before Coronavirus and After Coronavirus. AC will hit after the bottom out and COVID-19 is solved medically. When we start to rebuild, the world is going to be different and there will be an enormous amount of economic opportunities.

How Technology Will Be Impacted

o Whatever was the speed of trajectory for adopting new technology, it’s going to be much greater now.

o RIT: Ready to be Implemented Technological Advances.

Example, having servers at restaurants swipe cards at the table vs. having a cashier.

o Expectations will change – people will want things immediately.

o Vendors who supply goods will be in recovery mode. They’ll initially just want to make a little money to cover costs, not so much to make a profit.

What will happen with the global economy?

o The U.S. will emerge stronger because people are flooding to the U.S. to bring us their capital.

o People in other countries are bringing their cash to the United States, and their Human Capital.

o Canada is safe; it’s politically stable and has Law and Order.

o The U.S. is getting a four-fold reduction in debt service. It’s coming from people outside the U.S. pouring capital in the U.S., which bids up the price of the Treasury Bill, and drives down the interest rate.

o The U.S. has no real risk of debt. It just prints more money. When that happens the existing money is worth an equal percentage less than the amount printed.

o China will tool up faster than any nation. Their economy is based on making things. China’s going to be fully recovered the fastest. But they have a manufacturing economy that is highly dependent on workers having money in other countries.

Company Furloughs

o Some companies are paying salaries until they reopen. If the technical expertise of these companies goes to competitors, they won’t have a way to reopen.

o Re-opening is contingent upon when it is safe to have gatherings of more than 10 or 50 in a place.

The biggest factors relative to hitting the bottom and then quantum leaping are:

o When will we stop COVID-19?

o When are we going to have gatherings of people?

o When will people return to work?

TRANSCRIPT:

A Conversation with Leading Macro-Economist

Paul Zane Pilzer and Niurka

Welcome to the Supreme Influence Show, the space to embody your infinite potential and fulfill your highest destiny.

Hi, I’m Niurka, and I’m inspired to bring you this amazing episode.

Today we have a very special guest. He’s a world renowned Macroeconomist with a timely message. Right now, we’re in the midst of an unprecedented time in history: a global shutdown in light of the COVID-19 Pandemic.

And my guest is an expert in the economic recovery and rebuild in light of COVID-19.

If you’ve been feeling uncertainty about:

- the future,

- the economy,

- your family,

- your finances,

- your businesses,

in light of these challenging events, you’re going to love this episode.

Our guest, Paul Zane Pilzer is a Macroeconomist who has advised top government officials and CEOs worldwide. He’s served as an appointed economic official in two U.S. White House administrations.

He’s an entrepreneur who’s founded 5 companies in publishing, technology, commercial real estate, finance and health benefits. He’s employed thousands of people, invested in dozens of startups, and served on multiple boards of directors.

He’s a professional speaker, an adjunct professor at NYU, a writer, a New York Times best-selling author with 11 books. And he’s a dear friend.

I’m blessed to have known Paul for over 20 years. I met him when I was 19 years old, when Tony Robbins and I, and a few others went to his home in Park City, Utah. And we all went skiing and had a wonderful time. And Paul and I hit it off immediately. We enjoyed profound stimulating conversations, and we became friends. He mentored me in my early years in economics.

I share this story in my book Supreme Influence, recounting how in high school, I remember my economics teacher defining economics as: the distribution of scarce resources. Think about that definition: “scarce resources?” But Paul confirmed the wisdom that I felt in my heart…

He wrote about it in his book Unlimited Wealth, where he debunked traditional economic theories on scarcity and offered a new theory called Economic Alchemy, based on abundance. He revealed how our world contains unlimited resources because our creativity and ingenuity and exponential technologies empower us to continually evolve and define new resources and discover even better ways to use our existing resources.

I’m inspired to bring you Paul’s wisdom on today’s episode. It was recorded during a Saturday morning video chat, where I invited a small group of friends to join me in this conversation with Paul and ask a few questions.

Keep in mind that things are changing fast. And even though this is the case, this information offers you profound insight.

So, let’s dive in.

Hi, Paul. Welcome. Thank you so much for being with us.

Paul: Hi, everybody, and thank you for getting up this Saturday morning. I’m Paul Zane Pilzer, obviously.

Everyone Will Remember This World Epochal Event

What we’re looking at here is first, everybody will always remember, just like you were if you’re an American, when Kennedy was shot. You will always remember where you were when 9/11 hit. And this is that moment, if not larger already. Because this event has an immediate impact on everybody’s behavior in life, belief system. It’s like any other world epochal event… but it’s bigger.

And unfortunately, or fortunately, it doesn’t have an exact start date. It’s a date different for each of us. Some people, today they got home, logged on to their securities account and found ⅔ of their 401k gone, and that was just that day or that week, because they hadn’t looked at it. And then they go, “Oh my God,” what it was like each day. And they start focusing.

Paul’s Son Tests Negative for COVID-19

For some, it’s 2:13pm yesterday, for me, March 20. I had an event. I had been locked into prayer because I had a very sick son who is still very sick. And it looked like he had COVID. He has really bad pneumonia, and he’s got the later stage of not doing really well in this. And why I’m choking up now is because the good news before I get to it is at 2:13 pm, I got the notice that my 15-year-old son tested negative for COVID.

And we went through hell just getting tested because we sent in tests, they lost the test. And then they finally have a new State Lab that was doing the test three days ago.

I live in Utah, not California. What happened to the State Lab, it got hit by an earthquake, an earthquake! The first one we’ve ever had of any monumental things since living people moved into Utah, happened 3 days ago. And it happened on the day they were testing my son. So, they not only canceled the test, the COVID, I’m just sorry to go off on this. This is emotional. They not only canceled the test, somebody looked at it and said “He’s 15 years old, he’s going to live.” So, they canceled his test, even though they didn’t tell him that there were whole schools and other people he’d been with, who wanted to know right away if he had COVID. We tried 3 days in hell trying to get him tested.

So, we get another test at the hospital and we’re back and forth to the hospital to get him on a ventilator, to keep him breathing. And the 2nd test got tested and guess what? It was positive, being negative. It was a negative test. I got it framed on my wall here. I’ll remember that paper forever.

So, all of us are about to have if you haven’t already, monumental epochal events that we’re gonna remember all our lives from what happened here. And that’s what we’re going to discuss here.

Paul’s Expertise: Macroeconomics

My expert field, let’s say expertise within this. I’m a Macroeconomist. I like to think of myself as an entrepreneur. I’ve done 5 businesses today [worth] about $1 billion. No, no, before today, before this month, about a $1 billion Market cap. But more significantly, I like writing books. I have 11 books. And I like teaching. And I’m focused on the larger, larger economy. And particularly within the economy, my expertise is probably the Banking system.

I was very involved in helping fix the Savings & Loan crisis. And I wrote my first book, Other People’s Money (The Inside Story of the S & L Mess) in 1989, which was really about saving the S&L Crisis. And no one appreciates how close we came to the Banking system not working, which is what we’re having right now. Most of my calls like this, all of us have a brain trust. I think I’ve got about seven of these going. And I learn something from everyone. So that’s why I’m looking forward to learning from you. But each brain trust, most of them are financial or banking oriented, based on my old expertise, or at least I hope, today’s expertise, and how a Banking system works.

Don’t Leave Home Without Cash in Case of a Break in the Bank System Chain

First thing I did, which I’ll tell you to do, is do not go out of your house without $500 or $1,000 cash. Don’t. Because you will slide that credit card, and it will not work. Now, it won’t work because somebody is being tested for COVID, or taking care of his son, like I was doing the last 5 days. And that person didn’t go to work. So, the information that went from the Square account in your merchant where you’re buying coffee that ended, ended on down the line, or a chain, until it gets to the bank that says “Yeah, you’re good for the $30.” Pay the 30 bucks. Something’s gonna break in that chain, and then they’ll go get a guy to fix it. But the guy who fixes it may be out on COVID, for whatever reason, or taking care of someone.

Niurka: Now, what is the probability of that, Paul? Because like when you say it, you say it almost like it’s that fast, that that’s what going to happen?

Paul: Well, it’s happening. It’s 100%. It’s a question of whether it happens to you. It’s, our Banking system is depending on people getting up and going to work. When those people don’t get up and go to work, and don’t release things, you reach limits, and someone looks at the credit card and says, “past the limit.” There’s unlimited people.

I used to work at Citibank in the card business. And I’ve helped regulate this business most of my life on the Federal government. And so, you don’t see it because there’s redundancy and there’s someone to back it up. So, you probably have always had your credit card work if you had money in it. Or you’re used to moving money, and it’s instant, even though it always says “Can wait up to 24 hours.” But it doesn’t. It goes right away. Some of that’s not gonna work all the time. It’ll get fixed. I hope. I mean, I believe it’ll get fixed, so the system really collapsed.

But the point is, it doesn’t hurt to have cash.

Vital Lessons from His Father

And everything my father taught me. My father was born in 1903. He never finished high school. But he obviously lived through the Depression as a business person, an entrepreneur in 1930, 1935. And he wouldn’t let me out of the house without cash. I mean, the cash. He got this new credit card he got me. He wanted me to have cash because he was afraid something would happen in the car. I’d need to buy gasoline. But all these lessons I learned from my father, which is obsessed with the Depression, and my mother. All these lessons are coming back to me in spades now.

Combined with a fairly technical background in how [the] banking systems works and clear. So not to get, we don’t spend that much time. Just carrying a few hundred dollars cash.

What I do with my daughter, just happened to her. She was trying to buy gasoline, and she didn’t have enough money and she needed cash. I said “Go in your Subaru. Lie on the floor in the passenger seat. And you’ll see I taped a $100 bill inside the glove box on the upper part of the glove box,” which she’d never seen and spent because you got to get on the floor and look up to see it. She said, “When did you put that there?” I said, “A year and a half ago when we bought the car and you haven’t had to use it. Now you need some cash.” She was very happy to have it.

So, I’m pointing out all these little things my father taught me are becoming very relevant. And more significantly, we gotta. In this call, my field of expertise, honestly, is the Recovery and the Stabilization at the bottom. I’d love to tell you, I have some biological knowledge. And I’ve certainly read everything, we all do in this meeting of what is COVID? How long it’s gonna last? I don’t know if I have anything more to say about that than anyone else.

What I do have to say, and we should keep the questions on, is,

- What are some of the emergency things like running out of your debit cards not working, that may happen?

- How low the economy may go.

- More significantly, and most of it is really what the recovery looks like.

What Do We Do Once we Hit Rock Bottom?

I find it interesting. I’m a lot better today as a dad and as an economist with a son, not out of danger but out of COVID. So, I’m in a better mood. But meanwhile, I’ve been on all these calls with CEOs, mainly banks and financial regulators. And most of these calls, I’m focused on, they want my expertise on how we get out of this.

- Once we hit rock bottom how do we rebuild?

- And where’s it going?

The Positive Aspects of COVID-19: People Returning to What’s Most Essential

Now with that said, I’ll tell you, because I do want to get to questions. That said, I want to talk to the more positive side. If there are people who want to make money, and I’m not sure I don’t want to sound terrible about it, somebody is here to make money.

Right now, everybody’s thinking, “Who’s getting sick and how do we keep them alive?” But that will change. We will solve this problem. I do believe this is almost like God, not “God that cleaned the world should end,” but God firing a shot over our bow to say, “If I want to, I can eliminate you. But I’m not gonna eliminate you because I love the world,” says God, whatever higher being you believe in.

And this is a shot over the bow that say, “Wake up and hug somebody more and be more loving.” And frankly, Niurka, you’re much better at that than me.

Niurka: Well, that’s what we’re seeing right now, Paul. I’m seeing that in the conversations I’m having. People are returning to really being present to what’s most essential, what’s most important. And then really, it’s kind of like a recalibration of our entire world as old paradigms are kind of like, crumbling, that creates the space for new births.

Recovery of “V” vs. “U”: Get Ready for Unbelievable Growth

Paul: And that’s exactly what’s going on. And that’s your field, not my field. My field is: There are people who are going to want to, some people who would want to make a lot of money. Or at least rebuild the money they had that they felt secure with. And this is going to make any economic opportunity ever in the history the world pale by comparison, because our growth when we recover, most recoveries are “U” and that “U” means to stay at the bottom of the “U” and then it starts climbing up and climbing up and as it climbs, it gets steeper, because you get to the top.

That’s not what’s gonna happen here. It’s going to be a “V” overnight. When it hits the bottom, it’s going to go straight up. So, I’m gonna have a chance to “U” and start building a momentum. Because we know what we’re rebuilding. We know what we had before. Some things we like, some didn’t. Unlike an economy that says, “We have more Money, what should we spend it on,” the other one kind of a, “where should we live?”

- We know where we want to live.

- We know who we want to love.

- We know all these things.

And we just want to get back here right now. And that’s the positive side. Our growth will be unbelievable growth.

My expertise started in the oil crisis when we were running out of resources. We’re certainly not running out of any physical resources. And we’re going to need more love and more direction of what we want.

But all the assets to go rebuild the economy are going to be staring us right in the front, right in the face from what we need, in terms of what we know we want to build and how to build it. It’s sort of like we had the blueprints; we already built it. Now we’re going to rebuild IT, meaning our economy or some of it, but an incredible fast speed. So that those of us who had lost something, probably have knowledge and expertise that came with getting the money to get lost in the first place. And that knowledge and expertise is going to come to us in spades as this economy roars.

The New Roaring 20’s: 2020 to 2029

It’s interesting to me how this happened. I’ve spent a year now writing a book called The New Roaring 20s: 2020 to 2029. And in the New Roaring 20s, it explains how our economy is going to grow at unbelievable rates. But so will unemployment. And the new Roaring ‘20’s, that’s probably. I’ll tell this story and then we’ll jump open to questions.

So, in the New Roaring 20s book, which is so applicable now, the economy starts out in 2020, at $20 trillion, which is where it is. And I apologize, there’s some people here from outside the U.S. I’m going to use just U.S. numbers. It’s ones I’m more familiar with, but you can prorate them to any EU country and certainly to Canada.

So, we had in my new book, The New Roaring 20’s. I said, “In January 2020, we started out with a $20 trillion GDP. And we’re gonna raise that up to $30 trillion in nine years. And then it goes through chapter by chapter what the sharing economy is, all the different areas of the economy and why that’s happening. And why the Roaring 20s, which had the same growth rate, by the way, as THE Roaring 20s, meaning 1920 to 1929, had a 50% growth in the economy in nine years. And I’m saying that we’re going to duplicate but from a much larger base. And I’ve been focusing on the various aspects of the economy.

John Maynard Keynes Prediction: The Greatest Economist in the World

A lot of this is based on John Maynard Keynes, The Greatest Economist of the World, who established the Science of Economics. And Keynes wrote a letter in 1927, called: Letter to My Grandchildren. And in that letter, the world’s greatest economist said, “Children, grandchildren, here’s what the world will look like 100 years from now,” right? Actually, it was 99 years from now. “I won’t be around. But I want you to have my prediction.” And what he predicted was that by 1920, by 2028, which was 100 years, hence 100, you know, 100 years ago today, that’s eight years away. “By 2028,” he said, “We are going to be so rich as an economy due to technology doing all work, and so rich as individuals, that only one third of the population will work. And on average that one third that chooses to work will work 15 hours a week, which might be one long day and 15 hours flying, playing around the country, or it might be three hours a day, five days a week. And that minimal amount of work, 15 hours a week, plus only a third of the population working will produce all the food, shelter, music, art, everything else you want. The rest of us will just consume and enjoy. And couple off of somebody who does work. The opportunities for somebody who wants to make money will be unlimited, because not many people want to work. They’ll want to just enjoy.”

And we were heading towards that very quickly with millennials changing needs. And really, I’m very excited about the book. The publishers have been lining up too bid. And all of a sudden, we change something.

The World BC and AD: Before Coronavirus and After Coronavirus

Think of the world BC and AD. What does that mean to you? When I say BC, before Jesus Christ. And regardless what religion you are. I mean, I’m Jewish. Whether you be Muslim, Christian. BC is a big day. The day that Jesus Christ was born has the biggest impact I might argue on the civilized world, or the world we know. And then, then we have a new world called AD, which in Latin means after the event.

We have that right now. We have the roaring 20s right in the middle, and it breaks right here into Before Coronavirus, BC, and AC: After Coronavirus, because everything changes. Now I’ll argue that all those changes were in the works. That’s what I’ve been writing about for two years studying the last year, studying millennials. But they were gonna happen over a decade and now might happen over 1, 2, 3 years once we start to rebuild our economy. So, we’re all going to think of the world. Someone will say “Oh, you’re telling me about when you went to that restaurant. Was that BC? Or is that AC? Is that after Coronavirus? Because the restaurant we know is going to be different. Or Before Coronavirus ?”

And you start to see how we’re going to see in the next few years, an epochal event where everybody’s going to know where they were AC and BC. They’ll know where it started for them. For almost everybody, it started in March, but it’s a little different.

- As I said, for me, it’s the date, the big date that my son didn’t have Coronavirus.

- For so many people, it’s where they lost their money.

- For so many people, from their grandfather died of COVID.

And we’re not done with that. I mean, it’s really tough, something’s happening.

But BC and AC is going to be the big item. And what my expertise is, that I’d like to say I have something to contribute, is AC: After Coronavirus hits, and it bottoms out. And it’s solved medically because I’m not the guy who’s going to solve it medically. Nor do I have a lot to say on that. When that happens and we start to rebuild, the world ‘s going to be different. And the world’s going to have enormous, enormous amount of economic opportunities because it’s going to grow like a “V” not like a “U.” And if you don’t fully understand that, that would be a good question.

So, with that, Niurka, let me stop looking at my notes which is a whole book worth and turn to whoever turn it back to you. And we can run this thing interactively now.

Niurka: Definitely. Thank you so much, Paul. Demian. I know you always got some good questions.

How Technology Will be Impacted

Demian Lichtenstein: I’m definitely interested in your thought processes around how you perceive the technology moving sector wise. And what you perceive people are going to be focused on.

Paul: Your area is probably the same as any technological entrepreneur if I’m reading what you do. Now, all the product you produce is produced, basically, as a function of new technology and how well and how fast you and your cohorts use it.

Demian: Correct.

Paul: And if I’m reading that correctly, whatever was the speed of trajectory for adopting new technology, it’s going to be much greater right now. It’s going to be greater. Course, initially, you’re going to want vendors to do things is the bad news. And they’re not going to be there. Or they’re gonna say, “Hey, I used to have an operator who did this part of my video on my machine but he,” I don’t want to skip, “might be he’s sick taking care of somebody because of COVID. I mean the initial thing of you’re going to try to do business, it’s going to be very rough because we’re at the bottom. We’re not at the bottom yet but we’ll be at the bottom of our economic cycle waiting for recovery.

Meanwhile, on the other side, you know, let’s call it BC, about all this different technology and different pieces and different machines you were ready to implement. I call those an RIT: A Ready to be Implemented. R.I.: Implemented Technological Advance. An RIT. And in any business I walk into, I believe I said again, BC a month ago. I walked into an auto plant. And I said, “I could go to any company in America. Auto plant or your business. And sorry to say this, fire half the people and with a little bit of pain or energy, rebuild the whole company. Where, the people left would do all the work.

Most people don’t like to admit that, because it admits they were 50% bloated. But let’s say, use the word bloated, they were employing people who didn’t need to be employed just economically, you could get rid of them. Someone could do their job or bring in a new technology.

I see that in every restaurant, I see them in every process. I’m an economist. I walk into businesses, and I say, “Wow, the RIT’s, Ready to be Implemented Technological Advances that we could bring to this business starting with,” if it’s a restaurant, why do they take your credit card? Reserve the money? Why do they take a credit card, reserve the money, and then there’s pending stuff that should come right to your table and slide it on their hip as you’ve seen them do. And that saves a whole person back at the counter in a lot of restaurants, who are running the cash register.

I can go on and on that all this Technology was there Ready to be Implemented. When you rebuild your business, when your customers say I need this and this and this and this, they’re not gonna want it in a day. They’re gonna want it that day. And you’re going to rebuild your technology, I’m sorry to say this, of who you’re going to keep employed, who you’re not going to keep. And it’s going to be like the shot in the arm and your excuse to say I’m trying out a new machine; I’m doing it differently. Because no one likes to do things differently.

Now everyone knows to rebuild. We’re gonna have to do things a little differently. So, the massive amount of technology, whatever the speed, I was writing about that a businessman like you would have implemented these things over six months, it’s going to be six weeks or six days. Very, very quickly. And you’re also going to find this because we’re going to be in recovery mode that all the vendors that are supplying the stuff, and not worried about. They’re just worried about sales price exceeding marginal product cost. They just want to get a little bit of money not to make profit right now, but to cover their costs to get it out there.

So, in effect, we’re rebuilding so quickly in every area, when we start to rebuild. And we’re going to rebuild with new technology that will get to Keynes’ 2028, maybe in 2023, or some number. I’m using these just relative, because we’re going to get to the point where I was writing about, where the economy is basically consumers and people enjoying lifestyle. And less than a third of the people are working.

Demian: We were clear that this was going to ramp up. And I’m also clear about what you said that the technological boom, and where teams that used to require, you know, 5,000 people to punch out, you know, the CGI or the renderings for massive games or movies, it’s going to reduce to 500 people, and then that’s going to reduce to 50. And that’s happening as we speak.

So, I’m in agreement with your curve or your “V” rather.

Niurka: Thank you. Brittany.

Insights on the Global Economy

Brittany Burtz: Good morning. Hi, Paul. Nice to meet you. Thank you so much for your insights. And I would love to hear from you kind of, your perspective on how you seeing this impact not only the U.S. economy but the global economy. And what’s gonna happen with some of these other countries that we have trade with and do business with?

Paul: Let’s try to analyze that. One of the things that really upsets me as a student whose parents were born outside the U.S. and came here as refugees. And I grew up. My wife spent her first six years in a Malaysian refugee camp. She’s Vietnamese. And then came here as a refugee in the United States. So, we’re very open to a world view.

That said, the U.S. is going to emerge from this, unfortunately, so much stronger. And to a very great deal, the U.S. strength will be, hear me. I’m hesitating saying this, but I believe it is going to be at the expense of many other nations, almost like an evil war, where we conquered another nation, and then we strip out its resources. What’s happening right now is we are dealing with an environment in Washington of negative interest rates. And the negative interest rate means that somebody shows up on Friday, the way we finance our deficit each year or our government, is on a given Friday morning, The President Executive Branch or government Treasury Department needs, say $90 billion to make it through the week. Because that’s what we’re spending in excess what we’re taking in taxes, United States.

So, they take the $90 billion and they create a Treasury Bond, Bill, Treasury Bill, Treasury Bond, some are 30 days. Some are 60 days, 90 days, one year 10 year. And they take the 10-Year Bond and they go, “Who wants to get a million dollars in 10 years, paid at the window of the Treasury, US dollars?” Somebody says, “I want that. So, I’ll give you $9,900,000. It’ll grow in interest from $9,900,000 over the one week,” or the one year, whatever the time, “to $10 million.” And that’s how we figure out what the interest rate is. And that’s what we call the 10-Year Treasury rate. That’s normal.

And normally, somebody says, “I did $9.9 million.” And somebody says, “Now I’ll buy that piece of paper for $9 million, 9.1.” The next guy says, “I’ll take a little less interest. $9 million, 9.2.”

See, the more you spend, the less interest you get. The difference between the $1 million and the $995,000 you pay is the interest.

Now, what’s so scary is, people are flooding to the US to bring us their capital. And after COVID has done with its rampages in so many other countries,

- there’s no longer a guy in Indonesia, who has built a business, employs 300 people and has $5 million bucks in the bank. He’s taking that $5 million and he’s run to the United States.

- And he showed up on Friday at the Treasury window, but another guy showed up from Venezuela. He thought they were going to go democratic. He thought his only risk was political. And Venezuela might not have the systems.

- Or the breakdown in Law and Order, which is going to come in a lot of these countries and all parts of the world.

So, what we’re seeing is the same, the money which is really, think of the money as the seed corn. Every spring you have corn you put away each year every year as a farmer, your seed corn, that you’re gonna plant the next spring so you have it next year.

These people aren’t planting seed corn. They’re converting it to cash and running with it to the United States in some way. That props up our economy and devastates their economy. And that’s been going on now, with going on now, forever, the last, really, since 9/11. To some extent the rest of the world brings its capital to the U.S. AND they bring us more than their money capital, they bring us their human capital.

And what is the first bright kid when the lights go out? Meaning when the cameras are off? I do a lot of work in China. My Chinese host always leans to me almost, everyone and says, “So, Professor Pilzer. Where should I send my kid to college and buy a house in the U.S.?” And these are hot, top level Chinese officials, but they’ve gone through hell in their generations and back. And they want to have a safe place in the U.S. Well, now everybody wants safe place in the U.S. You see this where we have foreign nationals just the last decade, buy empty huge apartments and houses, to just own in the U.S., not so much as investment which is what they call it, but as a place to go run to if things go bad.

Well, now they’re going to stampede. So, what’s going to happen is, the U.S. will not only grow as I’m working on now, AC, After Coronavirus, out of this Great Depression, which is what we’re hitting.

And I need to comment on Depression Recession a minute. The U.S. will grow at, it will grow at the expense, Canada, by the way will absolutely grow the same way.

Niurka: Yeah, let’s talk a little bit about Canada because we’ve been doing quite a bit of business in Canada. What is your economic…

Canada’s Position: Politically Stable with Law and Order

Paul: Canada’s going to be like the U.S. It’s, it’s safe, it’s politically stable. So, if you start thinking, you know, socialism is bad, Communism is bad, we gotta fight that. The last country to go is probably the U.S. The second to last is Canada. And in Canada, we seem to have a population that’s very stable and most important, Law and Order. The scariest thing I saw before I came here. I’m here, I’m supposed to be here only on the positives. I’m here to help you AC, After Coronavirus, has bottomed out and now we grow.

But and we’ll grow mainly because, of course the U.S. and Canada will be in a unique position because of political stability. One factor I saw about an hour ago and opened up on the news was that every day, policeman in Los Angeles pull people over and they arrest 300 people a day. That’s normal.

Niurka: It’s gone down to like 60, now.

Paul: Yeah, that’s exactly the number. You have the same as I do. That’s the headline today. And it’s not that the crimes are not being committed. They put out a new guideline that says if somebody steals from somebody, don’t arrest them. We don’t have places for them. If they beat someone up and they’re a danger of beating someone else again, because it’s not a crime of passion, but crime against somebody, you probably need to bring them in. But one fifth in one day or in two days. And so, what we’re seeing is.

Niurka: Now, we can also say, though, that maybe some of those arrests weren’t like the most legit.

A Breakdown of Law and Order When Money Stops Flowing

Paul: I would agree. But to go from 300 arrests to 60 is a lot. More important, it’s not the arrests or how we’re prosecuting. It’s a breakdown of Law and Order when money stops flowing.

I mean, the real issue is, we’ve all gone to the supermarkets and seen the bare shelves. But every time I’ve gone, I found something to buy. I literally found. It wasn’t my brand, not the one I liked, but it was a new brand of this or disinfectant or any soap, laundry detergents, you’re trying brands now. You’re just grabbing it. You’re grateful to get it. What’s gonna happen when there’s nothing there? Right now they’re doing a great job, letting the supermarkets stay open and ignoring COVID right now, and saying it’s more important people get food. But I don’t know how that’s going to end up handling.

But I don’t like going there but because it’s not what I was saying. But it’s going to be rough till we get to the bottom. But in the clues of how we get to the bottom, we’re going to see what our recovery is going to look like faster. And mostly Canada is what I call politically stable. I’ve always felt that all the immigrants I’ve known going to Canada in my life, quickly became Canadians. They’re all from all over the world. But they get it real quickly.

The U.S. used to be like that when I grew up. But in the last 20 years, I’ve seen more and more immigrants come and stay more as immigrants than whereas the speed of simulation was faster. I’m 66. So, when I grew up, my English was not the language spoken in my home. But we assimilated real quick and my parents would always say, when I walked in the room, “Not in front of the kinder in Yiddish,” meaning, “Don’t talk German or Yiddish in front of the kids, because God forbid, they might not speak perfect English. And that hasn’t been the case.

The point is, we’ve got the seeds of discontent to sow, unfortunately, in the U.S. But we’ve got a much less in the U.S. and Canada than in other countries.

Niurka: What about Europe? Emmanuel, who’s here with us, who creates amazing documentaries. He’s from France.

Emmanuel: I think of the country, AC is going to be a different planet where we’re going to see an emergence of spiritual leaders and when I say spiritual, it’s from spirit from the new breath, the oxygen that people are lacking of right now. And people are tired of this you vs. me thing. It’s going to be a “we” world. It’s going to basically, finally put in reality and perspective, the beautiful test love that was the United Nations. WE the people ARE the United planet.

And I think what is going to happen is an emergence of a United world where everybody’s going to realize, “You know what, you might have these resources. We don’t. You might have these labs. We don’t. These energies. We don’t.” And vice-versa. And people are going to finally move to a world, a different world. It would be different, it would be different because we’re gonna have an emergence of new leaders.

Niurka: Okay, please, Paul.

Paul: I certainly share, you know, your enthusiasm and one world and how do I say this? Not my issues. Not what I do. I’m an economist. So, let’s come back to the first thing you said, which I really disagree with.

The U.S. borrows $23 trillion of which is such a ridiculous number because half of that are more, is borrowed from itself. It’s borrowed from other agencies within the government. So, we got to knock it down to like a $10 or $12 trillion. Compare that to Before Coronavirus: A $22 trillion GDP.

What matters is not the size of your mortgage on your home. What matters is the monthly payment. Interest rates in the U.S have just gone from 4%, 3%, 10-Year-Treasuries down to 0.4 and they’re gonna stay less than one, I believe for a long time. So, in effect, the U.S. just got a four-fold reduction in debt service, five-fold, maybe 100-fold, if we stabilize at .1%.

And where’s that coming from? It’s coming from people outside the U.S. pouring capital in the U.S. because for all their worries, they’d rather have it in U.S. dollars than any other item. That’s what bids up the price of the Treasury Bill, which drives down the interest rate. Because what, we’ve seen this anyway going on for decades, but never like we have in the last week.

So, the debt service is very easy for the U.S. to meet. AND, unlike normal debt, this isn’t debt backed by gold. This isn’t like the Chinese: if we don’t pay them their trillion and a half dollars back, they sail in warships. We just print it and give it to them. And guess what, when you print 20%, more money, all the existing money’s worth 20% less. That’s fine for them.

So, we have no real risk of our debt. And I’ve been writing about that since 1980’s and the Reagan Administration, when everyone said when interest rates at 20%, they were going to go to 30 and collapse the economy. And I said 1980s and I made a career of 40 years saying that it’s going to go to zero. And I used to say that as a euphemism. I thought maybe 1%, 2% down from 20. It went down to three, four and stayed there for the last three decades. And lately been heading lower and lower primarily due to overseas people, giving us more and more money.

But right now, the debt service is meaningless for U.S. debt. And again, it’s debt relative to your ability to pay it. We still make most of the products in the world that they need to keep their farms running, keep their trains running. We talk about China manufacturing everything. But a lot of this stuff, if not half of it, comes from U.S. companies. And those companies are going to emerge with After Coronavirus and sell the world.

China is going to tool up faster to return their economy. But unfortunately, their economy is making things. They were in the process over the next five years, starting this year, of shifting a consumer economy where their people enjoy more of their wealth themselves. China’s going to make all these things and how fast are you going to buy a new 80-inch big screen TV? Tesla’s.

Emmanuel: They have the money to buy it. That’s the problem.

Paul: Exactly. Tesla’s got a new plant in China. How fast are you jumping to buy that new Tesla or you want to wait a few months? So, China’s going to be fully recovered the fastest in any nation. But they have a manufacturing economy that is highly dependent on workers having money in other countries. And that’s not looking like that’s gonna happen overnight at least today.

The question really, the answer to everything is, today’s March 21. What’s it going to look like on March 31? Because that was the day that my company’s Planet Fitness gyms, different things I’m involved in. We closed 2000 gyms, 15 million U.S. members. And we closed on roughly March 17 and said we’ll reopen March 31. That’s still the plan. And I can go company by company, March 31 is a magic date that they told their stockholders and customers they’re reopening. I don’t know if they’re going to reopen March 31. The news certainly has gotten worse since March 18. Here we are in March. It’s unbelievable how fast it is. The news since March 18. When we closed our gyms at Planet Fitness is much worse today on March 21. And we made on March 18 a projection that we reopen for 15 million Americans that have a gym to go work out and get rid of their tension, on March 31.

I don’t know when that date is. I’m not gonna speculate when it is, but it’s probably longer than March 21. And that applies to every company doing the furloughs. Certainly, the larger companies are doing great. They’re saying we’re closing till March 21. I’m sorry, March 31. We will pay salaries till then. They have to because they have all these companies that are, is the technical expertise of their employees. If their employees just go to the other company or their competitor, they don’t have any way to reopen on March 31. So, right now they’re paying people.

We don’t know what’s going to happen on March 31. If they think it’s April 15, they’ll probably keep paying people to keep them around on April 1. But if they don’t think it’s going to reopen, in other words, everything today relies back to a medical projection you make of: When is it going to be safe to have gatherings of more than 10 or 50 in a place and when we lift these government restrictions and.

Niurka: That’s an unknown right now.

Paul: That’s not known. And I think, from a religious standpoint, because I don’t believe in the end of the world here. It’s gonna come. It’s gonna be a date when Coronvirus doesn’t win. And COVID 19 does not stop everybody from working and socializing. But that day, no one knows when that day is now. And it literally could be two or three days. I mean, the split, as long as I’m focusing.

To me, there’s just two ways to fight this thing.

- It’s stop contagion with quarantines, whatever, which, right now has worked in China, God bless them. And their political system allowed them to do that

- OR, let contagion go. Develop herd immunity. And everybody who gets it, have a cure; have something that cures the disease or treats the symptoms and keeps them alive. I look at two, Type 2 Diabetes. When you look at overweight people and Type 2 Diabetes is a subject I’ve written four books about. They didn’t have this problem when I was growing up.

The first thing I asked my biology friends,”Why wasn’t everybody so overweight and dragging around all this weight and unhealthy when I grew up? Where we they?” He says, “Paul, they used to die. They used to have heart attacks. They used to very quickly die. We’ve come up with all these drugs to treat Type 2 Diabetes, that almost like leading a lamb to slaughter, we keep them alive. We don’t tell them to lose weight and get healthy and work out. We tell them, “Here are these drugs that will keep you alive.”

And I don’t know where we’re gonna end up on COVID. But it’s going to be driven by the medical biology, not by the economics. My field, again, is once we have a start date, coming up with the projections and the numbers. The recovery, as the economy is today, is not going to be a rising tide lifts all boats. So, if you’ve got a business that was running, it’s not going to go, “Oh, the recovery comes the “V” and I just go up like the “V”. We’re going to completely retool:

- What fashions we want

- What foods we eat.

- How we get to the restaurant.

Everybody is going to be open to a new method. And so, when we recover, certain companies are going to cover really fast and instantly. And certain of them are going to never recover and certainly going to take a lot longer.

The Rebuilding of the Economy Will Have a Massive Amount of Winner and Losers

But it’s not going to be like we normally see in Economic Cycle. You go like this. And people say I was in the Great Depression. I was in the recession, it goes up, it goes down. No. The rebuilding of the economy will have massive amount of winners and losers, based on everything in every industry changing. Because people coming back to work, are going to put on a new hat and say, “How do I want to do this?”

As I talked about with Emmanuel, I think initially about this technology, the new technologies, he’s already thinking of what he’s going to implement.

Niurka: It’s definitely a new reset and with death, we know always comes rebirth is the nature of existence; new beginnings. When do you think the Market is going to bottom at what level and what industries are going to come out on top?

Paul: The biggest thing is, when’s it going to bottom is going to be:

- When are we going to stop COVID 19? The 19’s effects.

- So, when are we going to have gatherings of people?

- And when are we going to have people able to return to work?

And keep in mind one of the things that worries me, is in certain companies and certain places, let’s take Planet Fitness Gyms. In most, we as a company, made a decision to close the gyms. That said, 20 states simultaneously before we even could make it, closed us. Gyms are not allowed to be open. That means there’s a government bureaucrat there, who probably made a good move closing them. I gotta go find him. I got to talk to him when we’re ready to reopen. And he’s going to err on the side of caution. He’s gonna say, “Sorry, I’m not ready. I’m really busy. And I only work till 4pm. I’m a government bureaucrat, and I don’t want to take the risk, so talk to me next month.”

Meanwhile, a couple hundred thousand people stay out of work and 15 million people don’t get their gym for $10 bucks a month and the gym business returns to a bad business it was which was three year contracts and $50 bucks a month for everyone, instead of Planet Fitness

serving people at 10 bucks a month.

In other words, but then in other states, the state did NOT close us down. So, we can make an intelligent decision. We can retool workout procedures. So, we think we’re safe medically, get a clean bill of health and just open. Now, so you asked me a question, “When will the gym business return, Paul? You’re an active player in the gym business? You’re right about it.” “I don’t know.”

The biggest thing is, which states in the U.S. have outlawed gyms? And how are they going to turn them back on?

Niurka: Can you give another example of that? I just talked to my banker, and he said that he’s been flooded with requests for lines of credit. And one industry specifically was, he said that the dental industry is going to be shut down until about at least June. So, the amount of dentists that they have going to banks right now looking for lines of credit has completely spiked, unlike anything they’ve seen.

Paul: For the some reason.

Niurka: One more particular industry.

Competition and Changes in the Supply Chain

Paul: I have dear friends who are billionaires in the dental supply business, and they’re talking to me about all their supply chains. And one of them got a call from France that said, “Just give me every order you had in China, every monthly supply. I’ll cut the price 20% and make it in France.” He said, “Don’t even bother calling me up.” He kind of goes, “Give me the orders. Give me the Chinese documents.” He just wants get France back to work. And it’s making a good decision to make sure what and if China cuts the price, he says I’ll cut that price. This is a French pharmaceutical chemical manufacturer. In other words, there’s going to be some serious competition and serious changes in the supply chain everywhere. And it’s, it’s that’s, really that’s a lead to is, some companies are going to go up and some going down. And it’s the micro economists not me. I’m a macro economist, the micro economists who can study each individual business.

Right now, for example, what’s going on with unemployment. Companies, the CEOs are stepping up. First thing I saw week, last week was every CEO I could see in the news started out with “I am having my salary affected today.” You heard that everywhere. And now they’re going to: “I’m at zero salary.” Why? Because employees are zero. The company that lays off the fastest and goes to zero employees has the highest ever done because they still have sales in their supply chain from things that are already made. And that company stock goes up the highest. The company that doesn’t do that and tries to act compassionate, doesn’t have it stocked as a currency to go raise more money at and build out. It’s kind of terrible right now. And the hourly workers are all going to be massively cut in my mind in two days, eight days. I mean, the bad things that are happening are happening.

That said, all this will be driven by biology. We could still open Planet Fitness on March 31, like we told everyone we planned to a week ago, IF we get the COVID virus under control, either by stopping contagion – communicating it. OR, finding a cure for those who have it. OR a combination of both.

Niurka: Thank you for joining us for part one of this episode…I’m intending that you received

profound value. I know that I did.

And I’m excited to have you join us for Part 2, where we’re going to continue the conversation and you’re going to receive even more insights into the recovery and the rebuild in light of COVID-19.

Please be sure to share this episode with your friends, your family, your team, your loved ones, your community, because everyone can benefit from this wisdom and this knowledge.

I am so excited to see you on Part 2.

UPCOMING EXPERIENCES

A 2-Day Total Immersion Training Experience For Achieving Results

July 26 - 27, 2025

LIVE VIRTUAL

Nov. 7 - 10, 2025

LIVE Virtual

July 23rd - 26th, 2026

LIVE Virtual Experience

March 4 - 7, 2027

LIVE Virtual

June 23 - July 1, 2027

Bali, Indonesia